The only primary/prep curriculum in economics, business and finance

The lessons you wish you’d had

Accessible

Interactive

Meaningful

Financial literacy is an essential life skill that is often overlooked in schools. Tykeoons is here to change that, and to go further than just personal finance. Our structured, engaging, and practical curriculum introduces Year 4-6 pupils to the world of economics, finance and entrepreneurship in an accessible, interactive, and meaningful way.

Schools That Chose Tykeoons

Why Tykeoons?

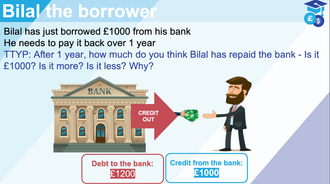

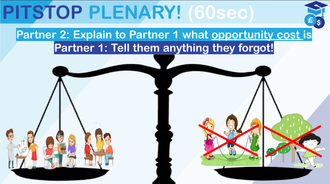

From understanding why we can’t have everything we want to making informed decisions about money, our program helps children build confidence in their financial decision-making skills.

Designed for Years 4-6, making financial education accessible from an early age.

Provides a structured, step-by-step approach that aligns with the national curriculum.

Created by education and economics experts for accuracy and relevance.

Engages students through interactive lessons, activities, and real-world applications.

Helps teachers reduce planning time by providing ready-to-use lesson plans.

Tykeoons makes financial education simple, engaging, and effective

What is Tykeoons?

A Complete Economics & Financial Literacy Curriculum

for Young Learners

Tykeoons is designed to fill a critical gap in financial and economic education for children. Our curriculum provides a structured yet flexible way for schools to introduce young learners to core economic and financial concepts, ensuring that they develop a practical understanding of how money works in the real world.

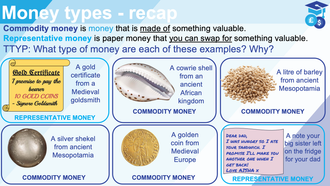

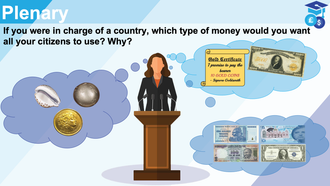

Our resources are carefully crafted to set a high expectation, to be engaging, easy to use, and to enable pupils to grasp important concepts through discussion, activities, and real-world examples. The program is structured into seven core modules, each covering a different aspect of economics, finance, and entrepreneurship, with a strong emphasis on critical thinking, problem-solving, and decision-making skills.

Understanding money, decision-making, and economics is essential for every child’s future.

Becoming a money-smart adult involves much more than basic personal finance knowledge. You need to understand the big picture and develop the right mindset and habits for financial success.

That’s why Tykeoons includes modules on economics, how money works and how to build the thinking skills that will help pupils one day make better money choices. Through a combination of real-world examples, hands-on activities, and discussion, pupils develop critical thinking skills that help them confidently navigate financial decisions.

How It Works

Bringing Financial Literacy to Life with Engaging, Ready-to-Use Lessons

1.

Instant Access to Resources

Once purchased, teachers and parents can immediately download and access the complete lesson materials.

2.

Engaging, Interactive Lessons

Our modules include slides, guided discussions, and

real-world case studies to make economic concepts relevant and relatable.

3.

Hands-On Activities

Each lesson comes with printable worksheets and activities designed to

reinforce learning in a fun and practical way.

4.

Progress Tracking

End-of-module assessments allow teachers and parents to track student understanding and development.

Who Is It For?

Our approach ensures that children don’t just learn about money—they develop the

confidence and skills to make smart financial decisions in real life.

For Teachers

Tykeoons provides fully-resourced, interactive and differentiated resources that make it easy to integrate economics, business and finance into your curriculum. With minimal preparation and no specialist knowledge needed, you can be up and running within days.

For Parents / Tutors

For homeschooling parents or tutors, Tykeoons provides a plug-and-play package that equips you with the tools you need to support your child's financial education in a way that is fun, interactive, and easy to follow.

For Schools

Schools have a duty to extend the curriculum ‘beyond the academic’, developing them as ‘active citizens’ (Ofsted, 2023) and to ‘promote the social and economic wellbeing of pupils’ (ISI, 2024). Tykeoons helps to ensure pupils are prepared for the financial decisions they will face as they grow older, setting them up to become money-aware and money-wise young adults.

Why an Economic Education should Start Early

The Growing Need for Financial Literacy in Young Learners

Financial and economic literacy is a weakness in UK education. We’re on a mission to change that.

Did you know . . .

✔ Only 48% of UK adults have basic financial literacy skills

✔ Young adults are three times likelier to fall victim to a scam if they didn’t have any financial education

✔ 35% of working-age UK adults have nothing saved for retirement

✔ Those with the highest financial wellbeing in Britain enjoy an average of 19 years longer life expectancy than those with the lowest

✔ Cambridge University (2013) found attitudes and habits related to money are formed from as young as seven years old

✔ The University of Wisconsin (2015) found that primary-age children

are capable of learning and retaining important economic and

financial knowledge

✔ The University of Michigan (2018) found that if poor money habits are not challenged between the ages of 5-10, they are likely to become permanent